edit_calendar

Accounting Record Adjustments

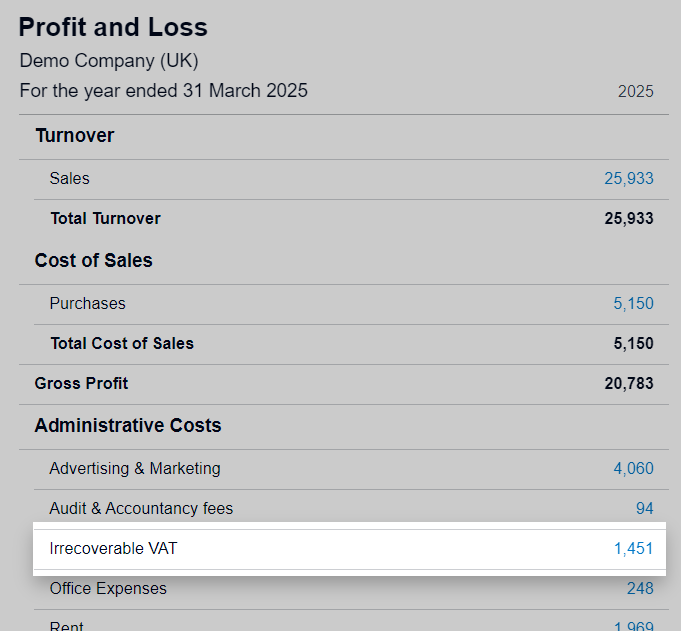

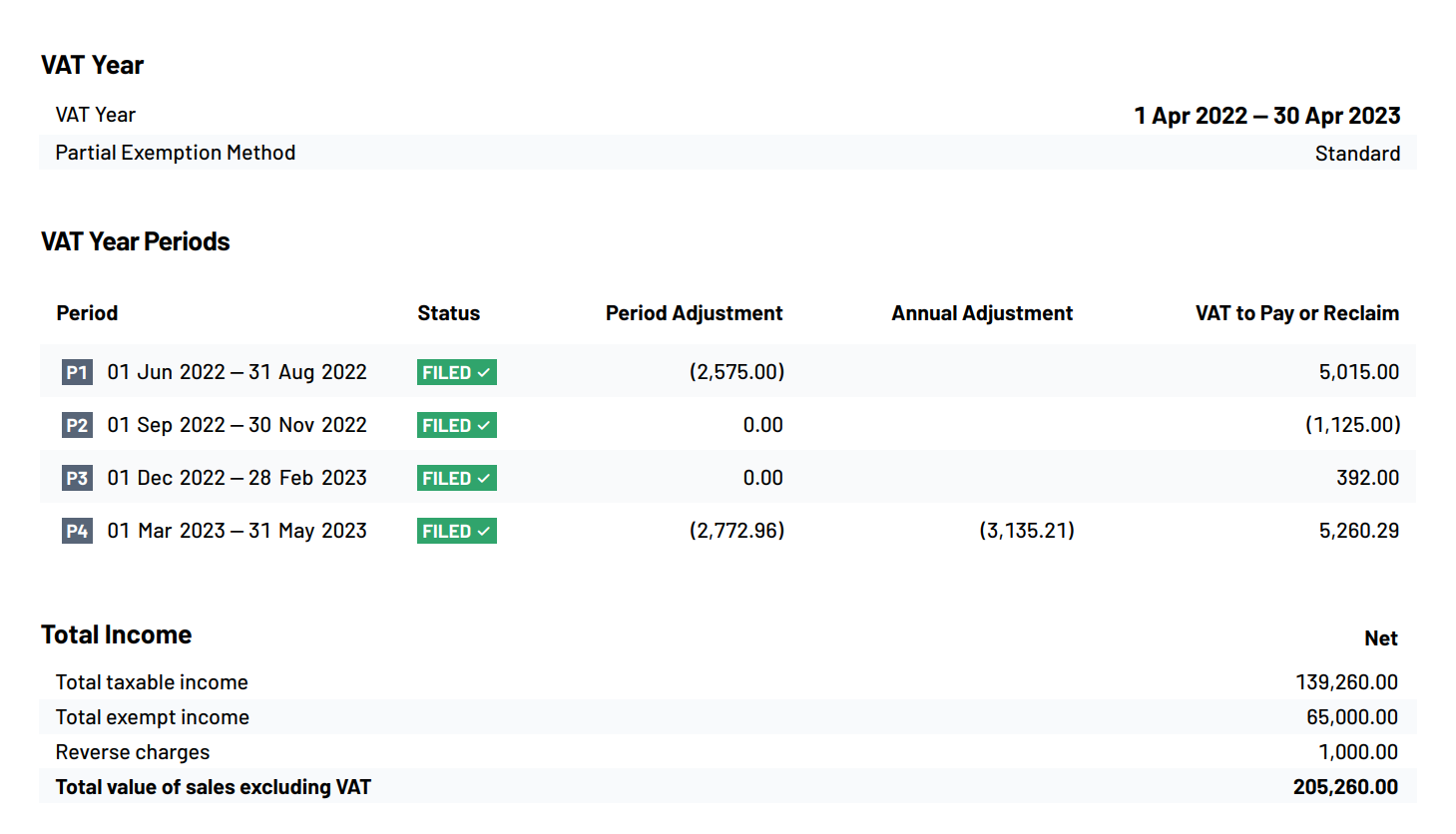

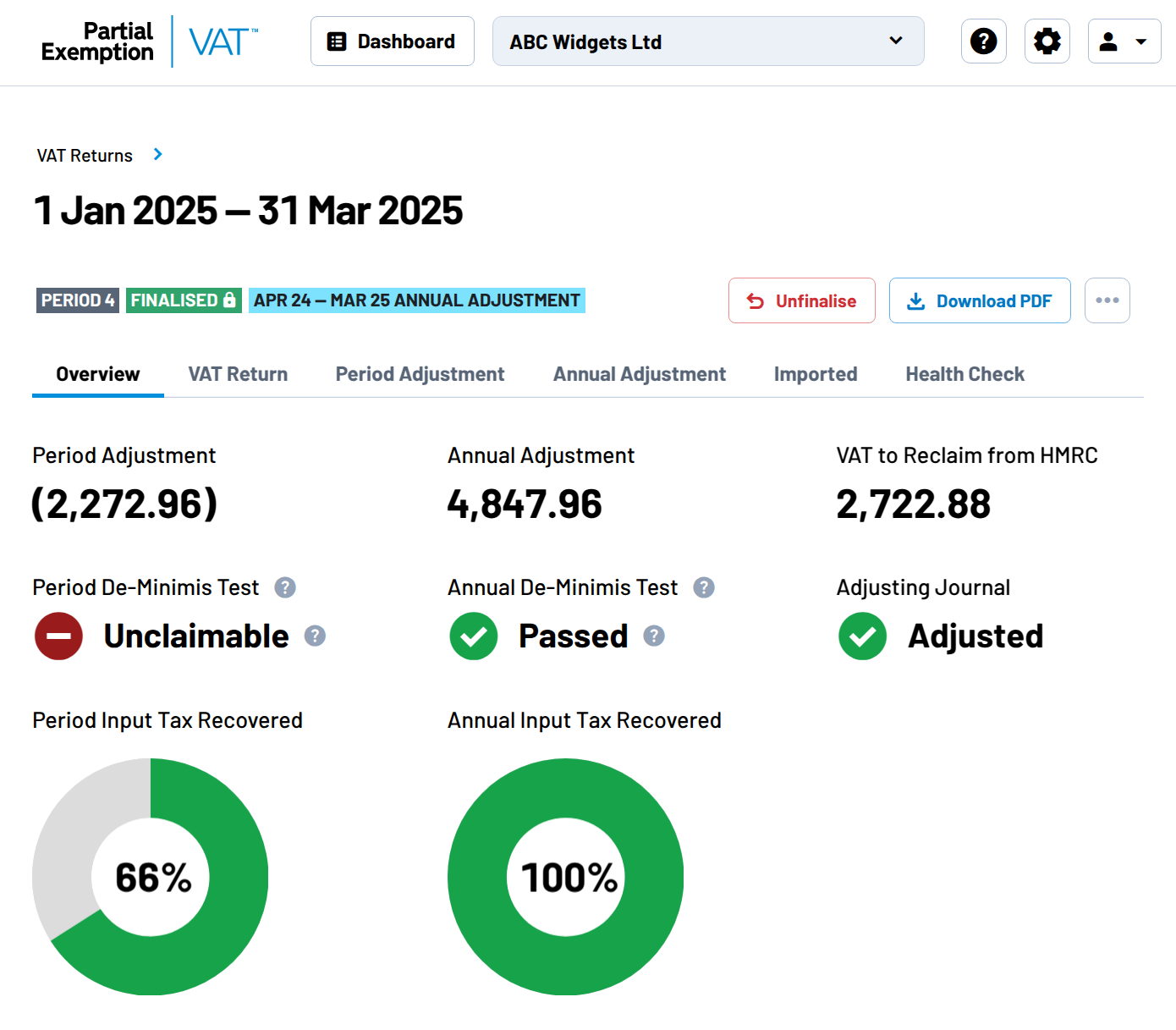

A common issue businesses face with partial exemption calculations is how to reflect the adjustment in the accounting records.

Since Making Tax Digital has been introduced by HM Revenue & Customs it has only complicated this process. Not only is an adjustment needed to correct the irrecoverable VAT but this adjustment also has to be reflected on the VAT Return ready for submission through the accounting software.

Making Tax Digital has eliminated the possibilities to amend the VAT Return manually when submitting through the HMRC website.

Partial Exemption VAT takes care of both the accounting records adjustments and VAT Return therefore putting your mind at rest knowing these are correctly posted as well as saving you time.

Making Tax Digital has eliminated the possibilities to amend the VAT Return manually when submitting through the HMRC website.

Partial Exemption VAT takes care of both the accounting records adjustments and VAT Return therefore putting your mind at rest knowing these are correctly posted as well as saving you time.