contact_support

FAQs

Is the software MTD compliant?

Yes, the Partial Exemption VAT software is fully compliant with all current MTD (Making Tax Digital) requirements.

Will you offer a free trial?

Yes, you will be able to try the Partial Exemption VAT software for free. If you decide not to continue with the trial, you won't be charged.

Which payment methods can I subscribe with?

You can subscribe using a credit/debit card or direct debit.

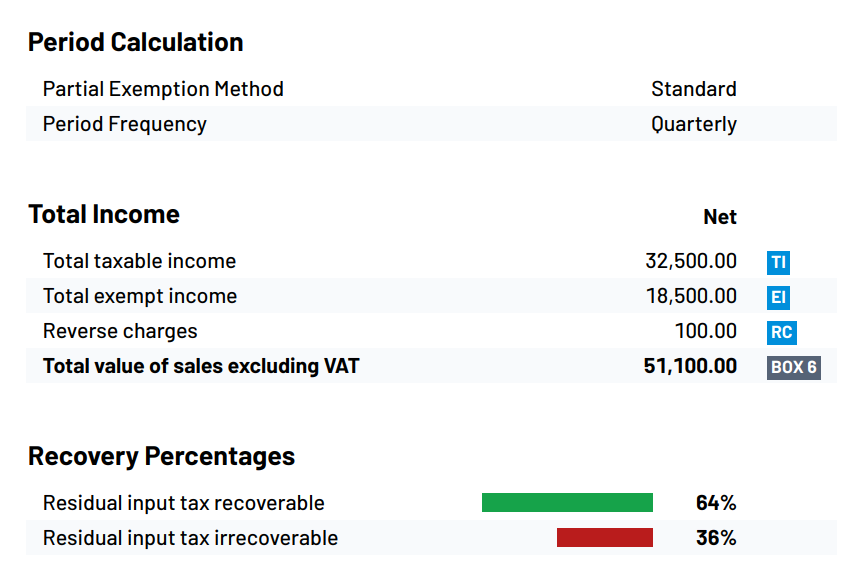

Which partial exemption methods do you support?

We support the standard, simplified and a number of special methods. We are continuously working to add more special methods.

How do I add partial exemption transactions?

Simply select the correct partial exemption tax rate in your accounting software. These tax rates will be created for you when you sign up, or you can select existing partial exemption tax rates you already use.

Can I download PDFs that show the full workings of the calculation?

PDFs of your calculation are automatically generated for each VAT return and these can be downloaded from your account at any time. If you are using Xero, these are also automatically attached to the adjustment journal entry and your Xero Files library.

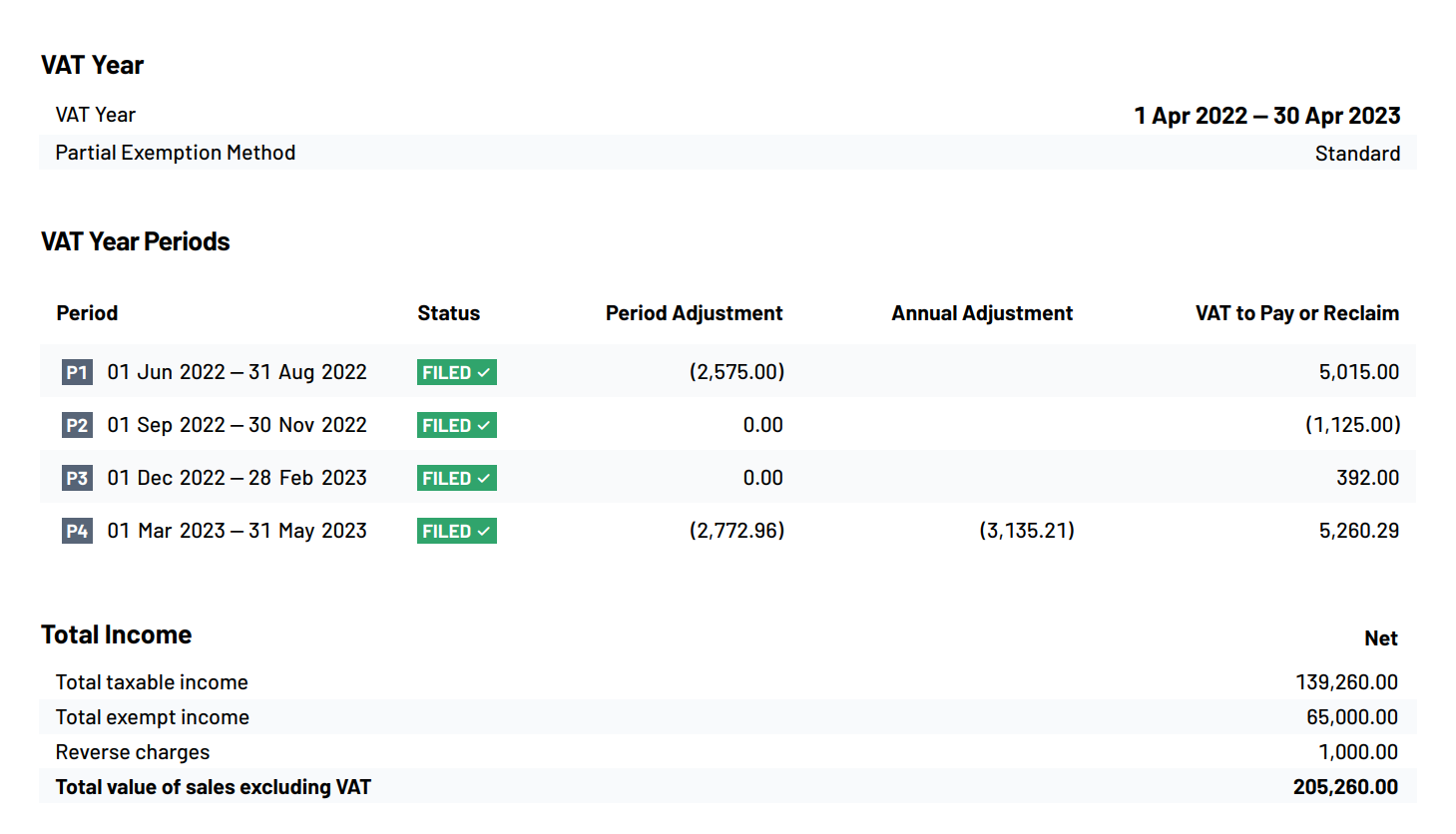

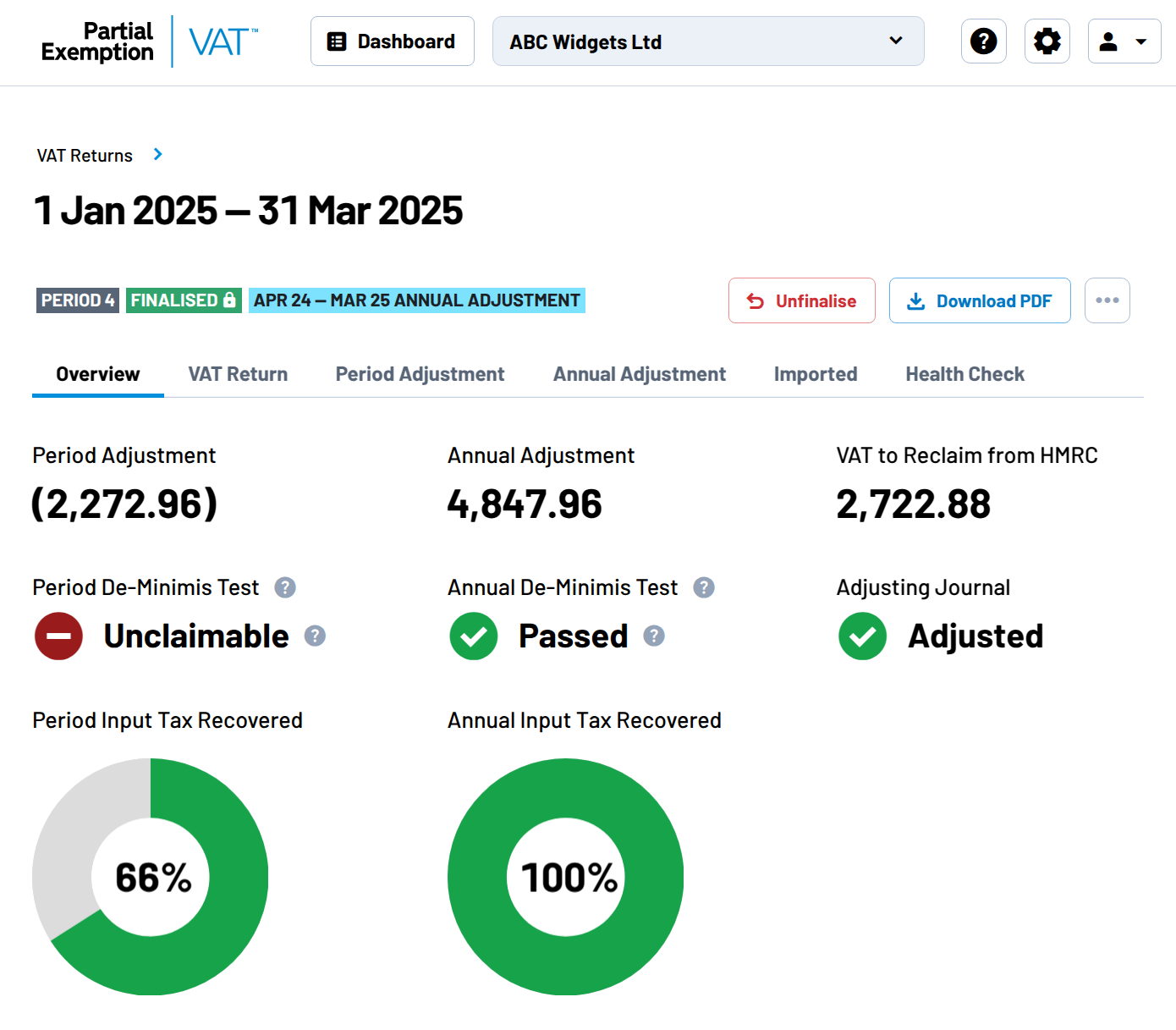

How do I calculate Annual Adjustments?

The Partial Exemption VAT software handles annual adjustments automatically for you.

How do I correct mistakes?

VAT returns in the Partial Exemption VAT software can be deleted as long as they have not been submitted to HMRC. The irrecoverable VAT adjusting journal will be voided automatically.

Can multiple users use the Partial Exemption VAT software for one organisation?

Yes, the Partial Exemption VAT software supports unlimited users at no extra cost.