history

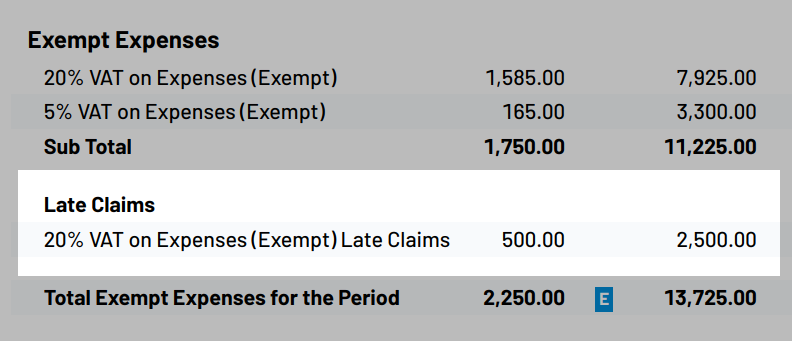

Late Claims

Partial Exemption VAT will automatically include any Late Claims in your annual adjustment calculations to ensure the correct recovery percentage is used to calculate any irrecoverable Input VAT.

When preparing VAT returns, it is quite common for items to be missed from a return. Providing these items are no more than £10,000, these can be simply included in a later period.

However, for your partial exemption annual adjustment, it is important that these Late Claims are included in the correct VAT Year.

Partial Exemption VAT will automatically include any Late Claims in your annual adjustment calculations to ensure the correct recovery percentage is used to calculate any irrecoverable Input VAT.

However, for your partial exemption annual adjustment, it is important that these Late Claims are included in the correct VAT Year.

Partial Exemption VAT will automatically include any Late Claims in your annual adjustment calculations to ensure the correct recovery percentage is used to calculate any irrecoverable Input VAT.