FreeAgent Partial Exemption

FreeAgent and Partial Exemption VAT integrate together for quick and easy VAT Partial Exemption calculations, from bookkeeping to submitted VAT return.

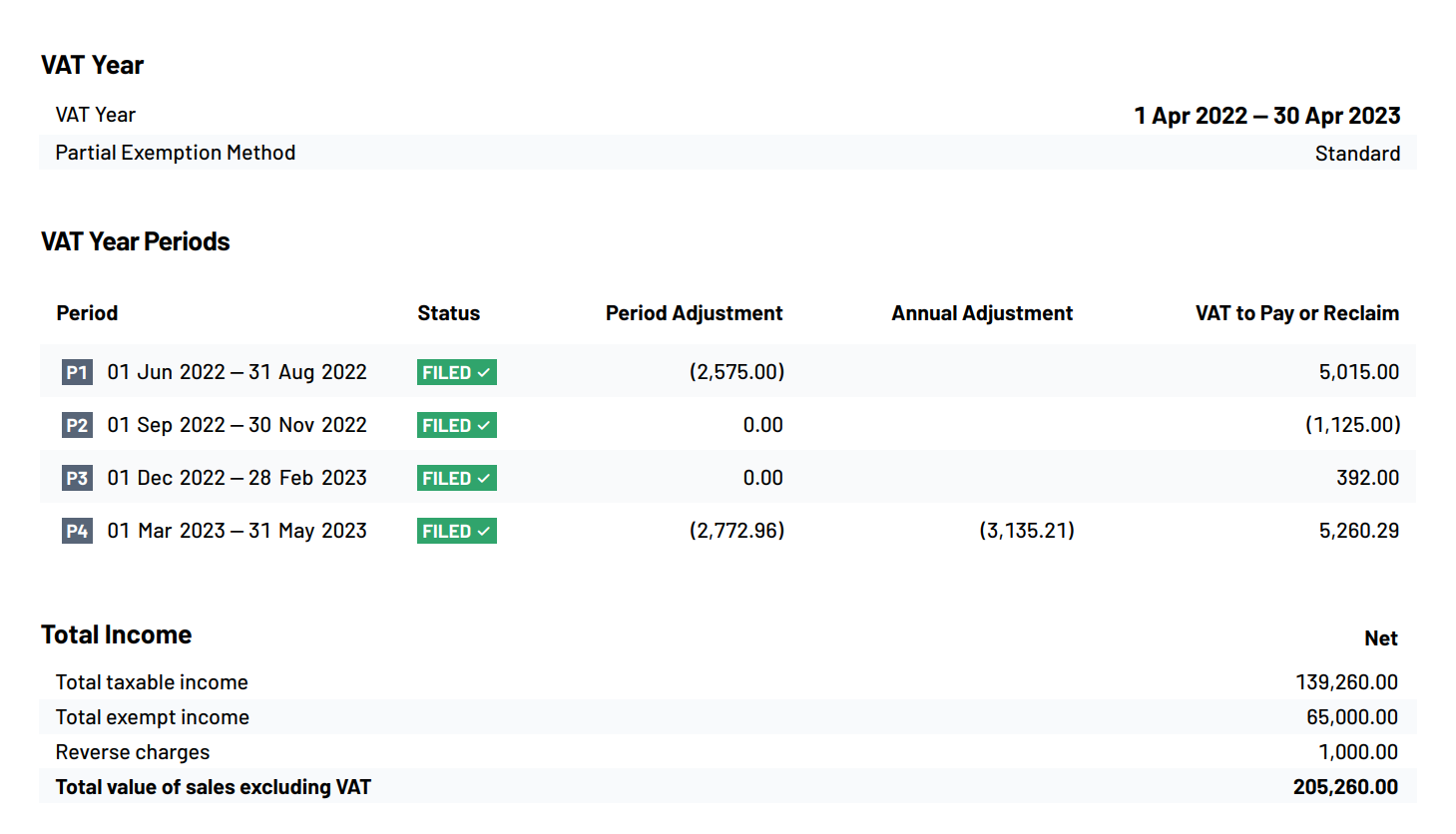

Partial Exemption adjustments are automatically calculated based on items assigned to tax rates, and journal entries are pushed to FreeAgent for quick submission of VAT returns to HMRC.

Integrate FreeAgent with Partial Exemption VAT

Managing complicated and error-prone Partial Exemption workflows such as spreadsheets is no longer needed. Request early access today to connect Partial Exemption VAT to your FreeAgent, to help streamline your Partial Exemption calculations and VAT returns.Integration Features

Automatic import of items from FreeAgent VAT returns to Partial Exemption VAT

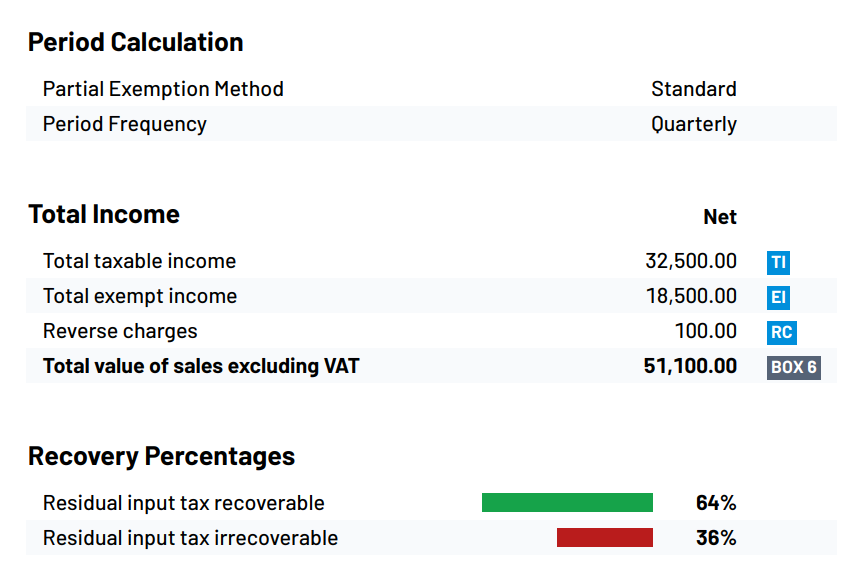

Simply assign items to Partial Exemption tax rates within FreeAgent, import a VAT return and let us handle the rest. Items for Partial Exemption are automatically imported from FreeAgent VAT returns.Automatic calculation of VAT recovery

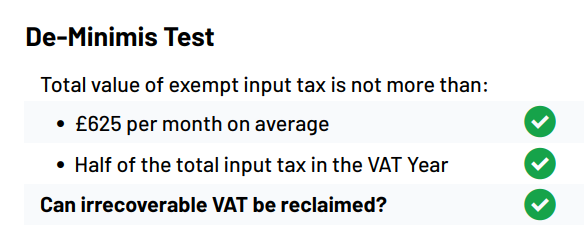

Partial Exemption calculations are performed automatically, including support for the Standard, Simplified and Special methods.

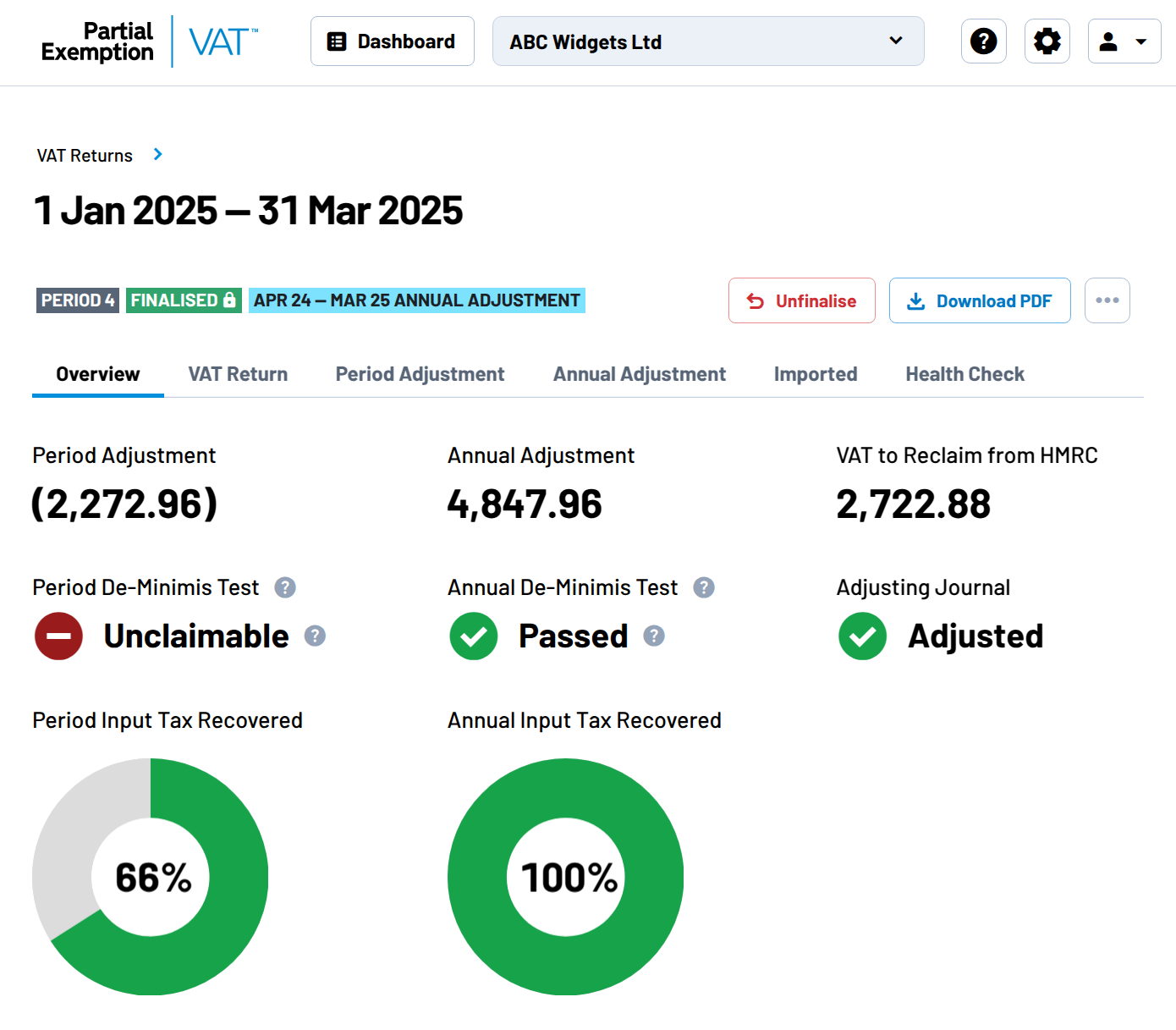

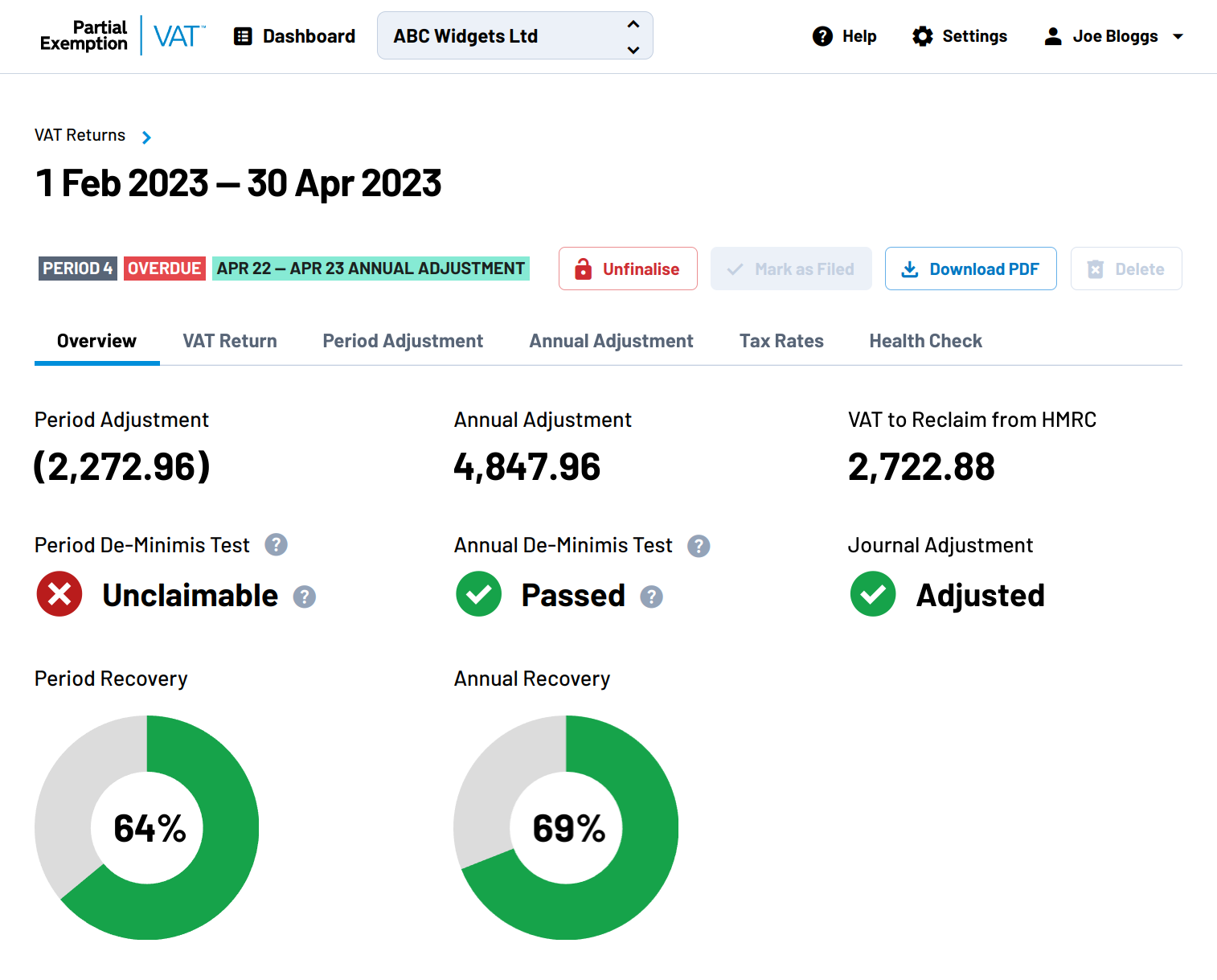

Automatic Annual Adjustments

Annual Adjustments are automatically calculated and included in either the first or last VAT return of the VAT Year.Push journal adjustments from Partial Exemption VAT to FreeAgent

Once your Partial Exemption calculation has been completed, you can push journal adjustments to FreeAgent in one click, making VAT returns submission to HMRC quick and easy.Instant full reports and calculation workings for your firm, client and HMRC

Full reports of the Partial Exemption calculations are viewable or downloadable as PDFs, allowing your firm, client and HMRC to instantly review and confirm the Partial Exemption calculations.Automatic PDF report generation for journal entries within FreeAgent

When VAT returns are finalised and journal adjustments are pushed, PDFs of the calculation workings are automatically generated and attached to the FreeAgent journal adjustments for easy auditing.Clear insights to your client's Partial Exemption position and potential future VAT savings

Maximise VAT savings for your client through clear visiblity of their future Partial Exemption VAT position.

How does it work?

When you connect FreeAgent and Partial Exemption VAT, Partial Exemption tax rates are created or mapped, ready for you to use in FreeAgent to assign items applicable to Partial Exemption.When a VAT return is due, the VAT return can be imported into Partial Exemption VAT quickly, with Partial Exemption calculations carried out automatically.

Once finalised, VAT return journal adjustments are posted to FreeAgent, ready for seamless VAT return submission to HMRC.