event_available

Annual Adjustment

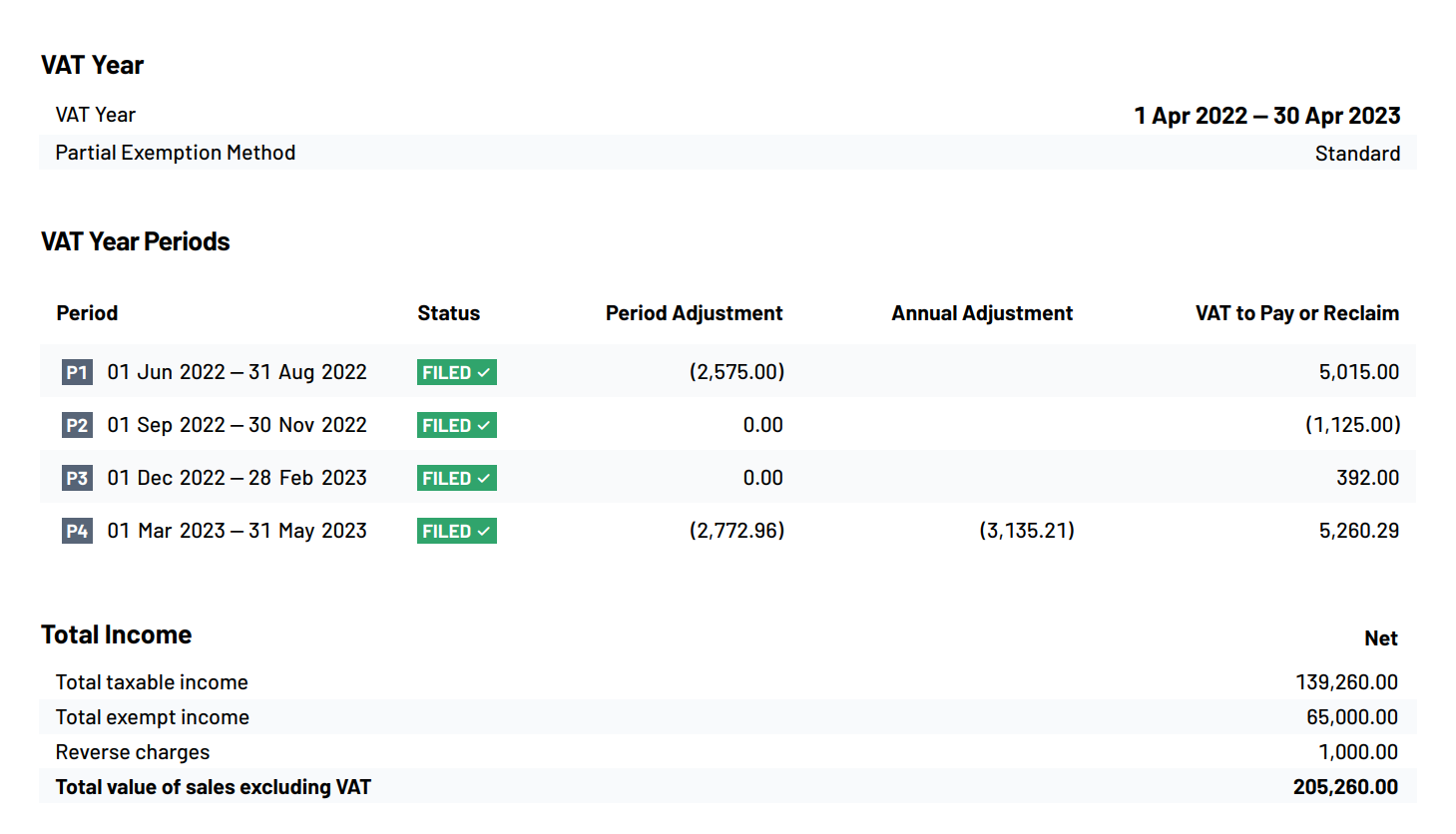

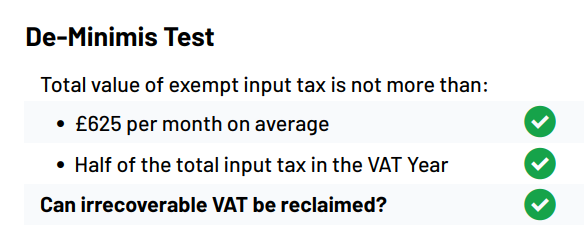

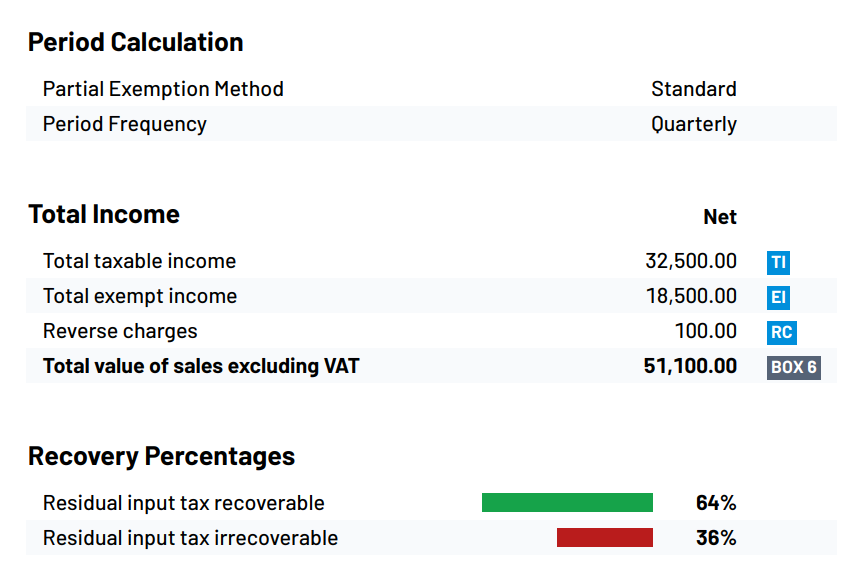

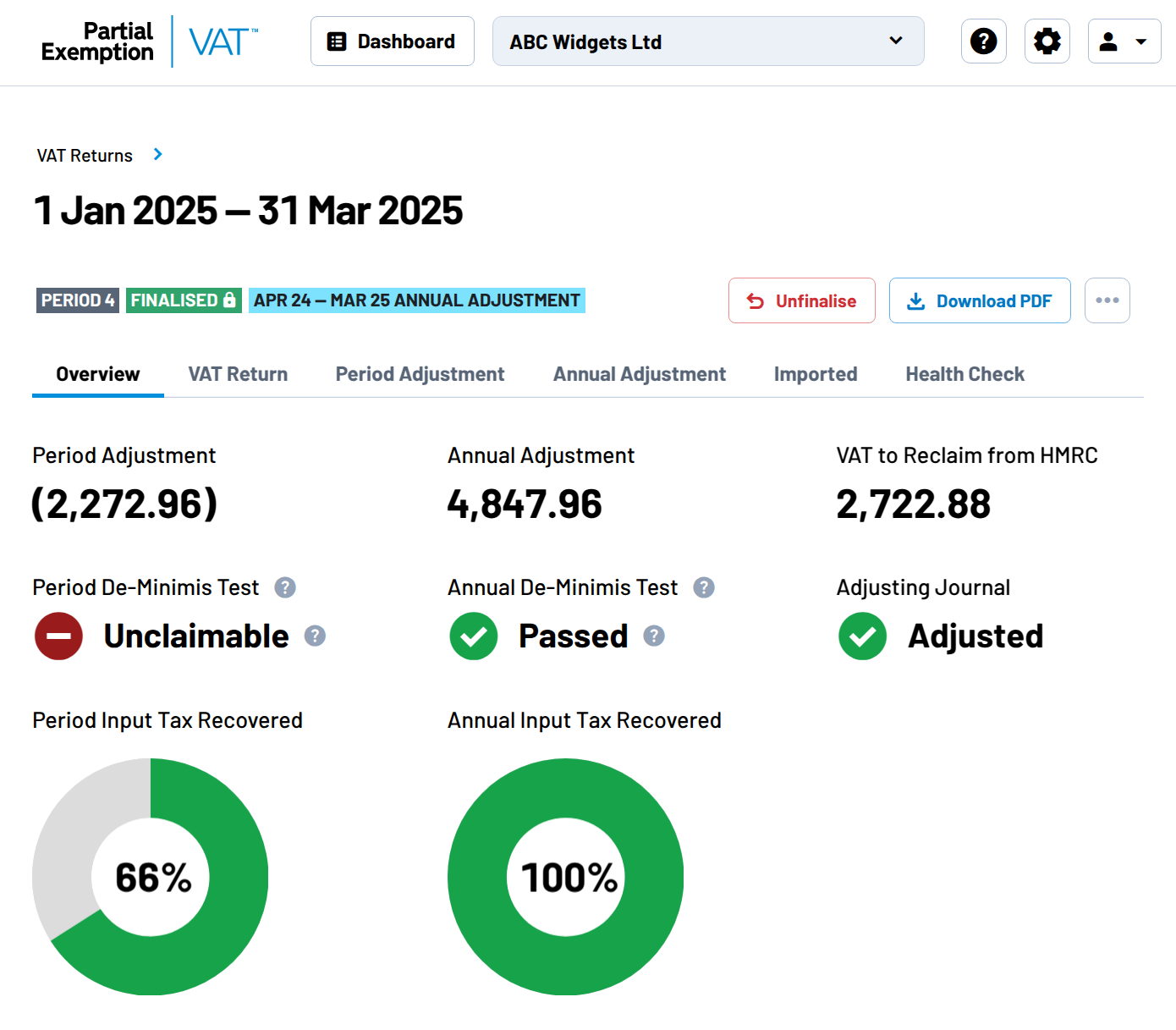

Not only does Partial Exemption VAT prepare your monthly and quarterly calculations, it also takes care of your annual adjustment.

You have the choice to declare your annual adjustment with the final VAT Return of your VAT year, or with your first VAT Return of the following VAT year. You can choose your preferred option without having to notify HMRC in advance.

Partial Exemption VAT caters for this by offering you the choice of which VAT Return you would like to include your annual adjustment.

Also, when you first connect Partial Exemption VAT, you have the option to import a selection of historical data meaning you can start using the app straight away rather than having to wait until the start of your VAT year.

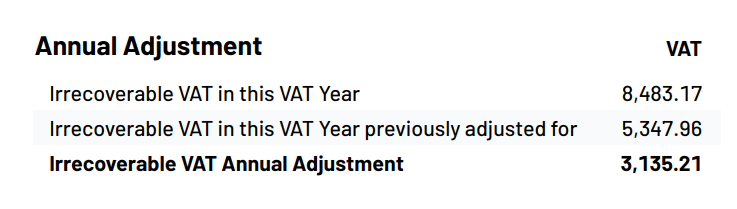

The annual adjustment is automatically calculated through Partial Exemption VAT with no additional work.

Partial Exemption VAT caters for this by offering you the choice of which VAT Return you would like to include your annual adjustment.

Also, when you first connect Partial Exemption VAT, you have the option to import a selection of historical data meaning you can start using the app straight away rather than having to wait until the start of your VAT year.

The annual adjustment is automatically calculated through Partial Exemption VAT with no additional work.