inventory_2

Recording Keeping

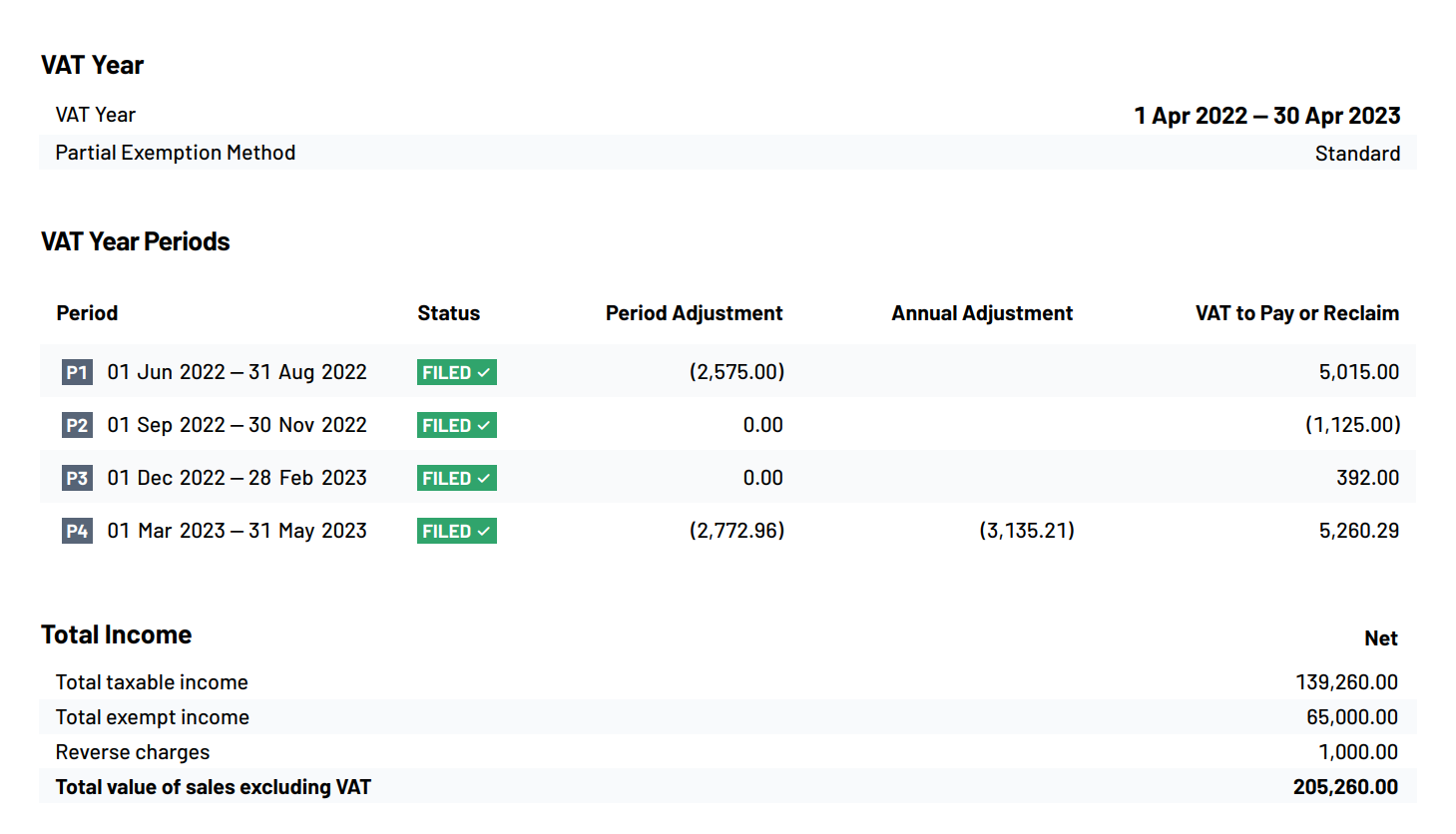

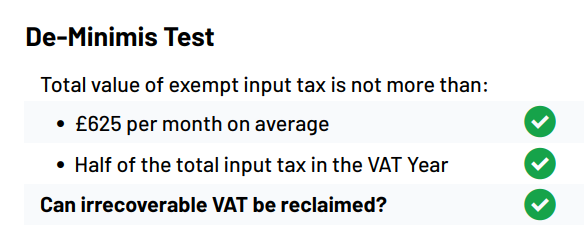

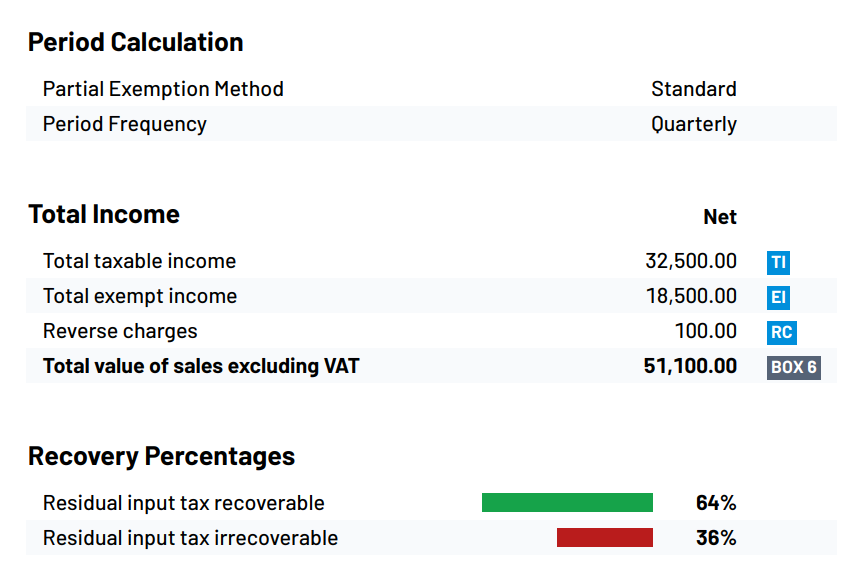

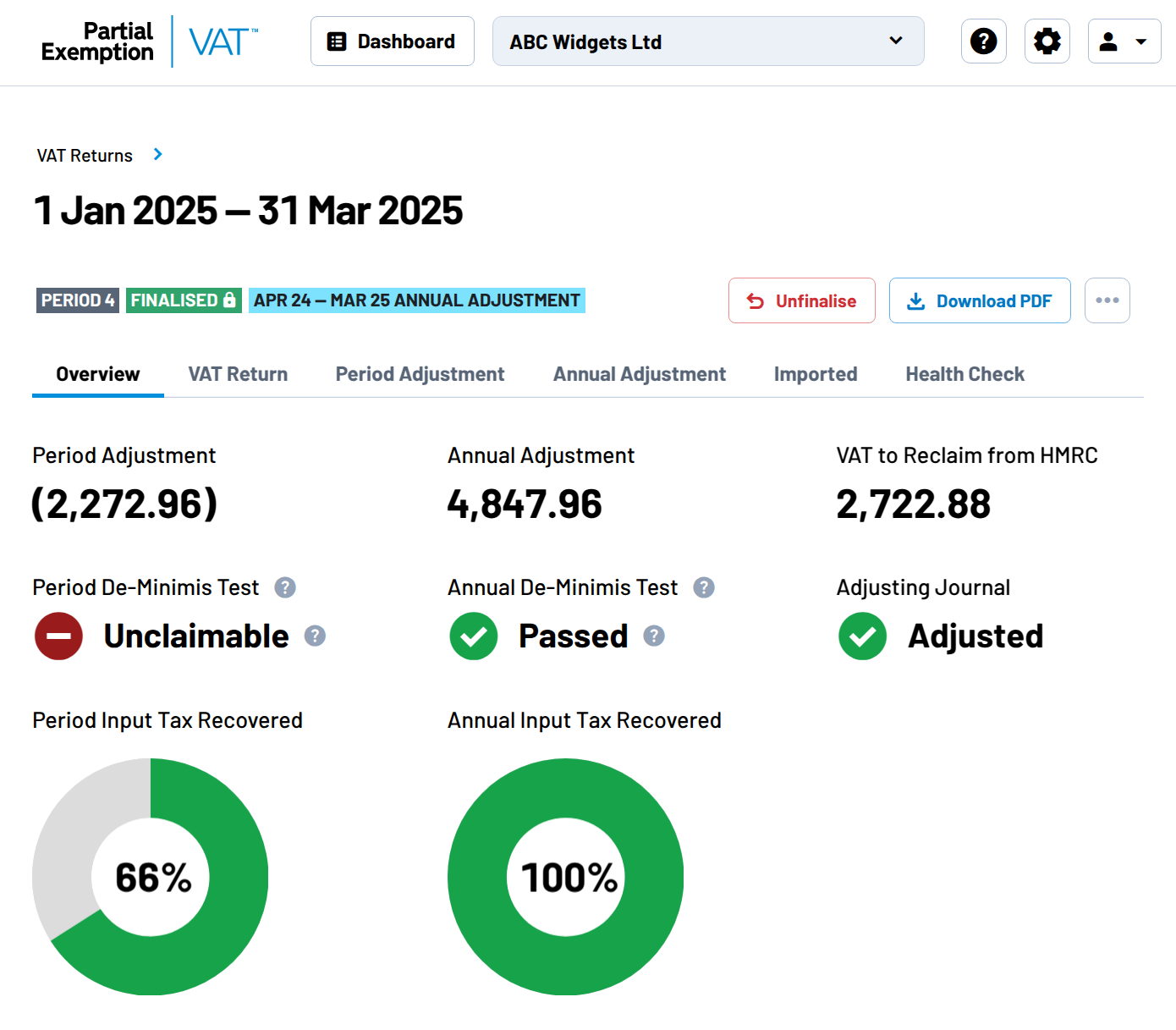

Partial Exemption VAT produces reports that breakdown each step of the calculation, working out the irrecoverable VAT amount as well as the check against the de minimis rule.

These reports provide complete transparency of the how the adjustments are calculated from the data that was originally input into your accounting software right through to the final partial exemption adjustments.

The reports are then automatically stored to the cloud as well as exported into your accounting software meaning you comply with HMRC regulations.

The reports are then automatically stored to the cloud as well as exported into your accounting software meaning you comply with HMRC regulations.