calculate

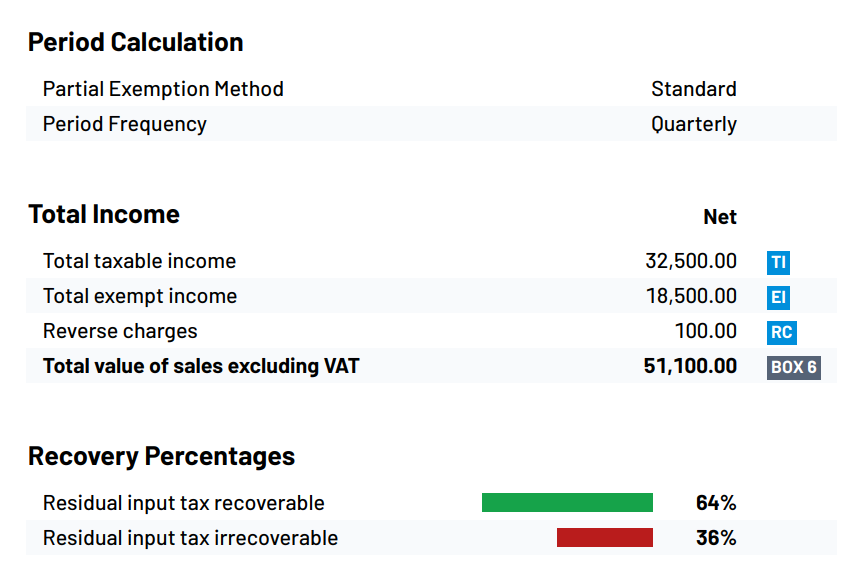

Standard, Simplified and Special Methods

Depending on your business circumstances, you may choose to use the partial exemption special method over the standard method. Details of these can be found in HMRC's Partial Exemption VAT Notice 706.

Partial Exemption VAT can cater for both.

As well as the standard method calculation, we have a varied selection of methods you can use to calculate the recovery percentage and total input VAT you can reclaim.

As well as the standard method calculation, we have a varied selection of methods you can use to calculate the recovery percentage and total input VAT you can reclaim.